Advertisement

-

Published Date

October 19, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

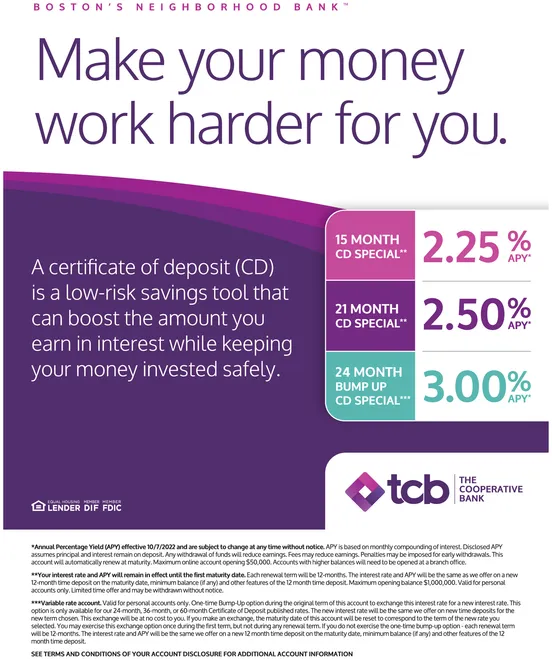

BOSTON'S NEIGHBORHOOD BANK Make your money work harder for you. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested safely. LENDER DIF FDIC 15 MONTH 2.25% CD SPECIAL** 2.50% 3.00% 21 MONTH CD SPECIAL" 24 MONTH BUMP UP CD SPECIAL*** tcbl THE COOPERATIVE BANK *Annual Percentage Yield (APY) effective 10/7/2022 and are subject to change at any time without notice. APY is based on monthly compounding of interest Disclosed APY assumes principal and interest remain on deposit. Any withdrawal of funds will reduce esamings. Fees may reduce eamings. Penalties may be imposed for early withdrawals. This account will automatically renew at maturity. Maximum online account opening $50,000. Accounts with higher balances will need to be opened at a branch office **Your interest rate and APY will remain in effect until the first maturity date. Each renewal term will be 12-months. The interest rate and APY will be the same as we offer on a new 12-month time deposit on the maturity date, minimum balance (if any) and other features of the 12 month time deposit. Maximum opening balance $1,000,000 Valid for personal accounts only. Limited time offer and may be withdrawn without notice. ***Variable rate account. Valid for personal accounts only. One-time Bump-Up option during the original term of this account to exchange this interest rate for a new interest rate. This option is only available for our 24 month, 36-month, or 60 month Certificate of Deposit published rates. The new interest rate will be the same we offer on new time deposits for the new term chosen This exchange will be at no cost to you. If you make an exchange, the maturity date of this account will be reset to comespond to the term of the new rate you selected. You may exercise this exchange option once during the first term, but not during any renewal term. If you do not exercise the one-time bump-up option-each renewal term will be 12 months. The interest rate and APY will be the same we offer on a new 12 month time deposit on the maturity date, minimum balance (if any) and other features of the 12 month time deposit. SEE TERMS AND CONDITIONS OF YOUR ACCOUNT DISCLOSURE FOR ADDITIONAL ACCOUNT INFORMATION BOSTON'S NEIGHBORHOOD BANK Make your money work harder for you . A certificate of deposit ( CD ) is a low - risk savings tool that can boost the amount you earn in interest while keeping your money invested safely . LENDER DIF FDIC 15 MONTH 2.25 % CD SPECIAL ** 2.50 % 3.00 % 21 MONTH CD SPECIAL " 24 MONTH BUMP UP CD SPECIAL *** tcbl THE COOPERATIVE BANK * Annual Percentage Yield ( APY ) effective 10/7/2022 and are subject to change at any time without notice . APY is based on monthly compounding of interest Disclosed APY assumes principal and interest remain on deposit . Any withdrawal of funds will reduce esamings . Fees may reduce eamings . Penalties may be imposed for early withdrawals . This account will automatically renew at maturity . Maximum online account opening $ 50,000 . Accounts with higher balances will need to be opened at a branch office ** Your interest rate and APY will remain in effect until the first maturity date . Each renewal term will be 12 - months . The interest rate and APY will be the same as we offer on a new 12 - month time deposit on the maturity date , minimum balance ( if any ) and other features of the 12 month time deposit . Maximum opening balance $ 1,000,000 Valid for personal accounts only . Limited time offer and may be withdrawn without notice . *** Variable rate account . Valid for personal accounts only . One - time Bump - Up option during the original term of this account to exchange this interest rate for a new interest rate . This option is only available for our 24 month , 36 - month , or 60 month Certificate of Deposit published rates . The new interest rate will be the same we offer on new time deposits for the new term chosen This exchange will be at no cost to you . If you make an exchange , the maturity date of this account will be reset to comespond to the term of the new rate you selected . You may exercise this exchange option once during the first term , but not during any renewal term . If you do not exercise the one - time bump - up option - each renewal term will be 12 months . The interest rate and APY will be the same we offer on a new 12 month time deposit on the maturity date , minimum balance ( if any ) and other features of the 12 month time deposit . SEE TERMS AND CONDITIONS OF YOUR ACCOUNT DISCLOSURE FOR ADDITIONAL ACCOUNT INFORMATION